STRATEGIES

To Profit In Futures

The Most Important Strategy to Profit In Futures Is

The “Gold Line” Strategy

This strategy is explained about 1/3 of the way down this page under the red box heading of the first indicator that I use in trading.

WHICH WAY IS THE TREND?

The first thing that you will want to do, before looking for a good place to enter a trade, is to determine which way the market is trending. Is it trending up, down, or sideways. In order to do this adequately, you may want to set the chart to one day, and then down to about one hour. It is important to know the trend. Don’t get too distracted by long term trends though, the most important trend is the trend that has been going for the last 15 to 45 minutes. The short-term trends often change every 20 to 30 minutes, or every hour, though it may go for six hours or more. If it was trending up an hour ago, but now it is trending down, the major daily trend is important, but you will often want to give more weight to the current trend. It will be safer to only make trades with the current trend, or wait until price is trending the way the you want to trade. As they say, “the trend is your friend.” You will be safer if you do not make any plays against an upward or downward trend. The general way to know that a trend is going a particular way is to see movement in one direction primarily, with some pullbacks that go back the other way, but then the trend continues after the pullbacks. If you would like to be more clear about recognizing a trend, click here to go directly to the part on the page below that addresses it in more detail. There is a paragraph of explanation and then an illustrative chart.

Now, if the trend has ended and the price action is consolidating sideways and it has been moving from top to bottom of the range for about 20 minutes or more without excessive volatility, particularly after the market is closed, you may find a good opportunity to buy or sell at both sides of the range, just as it begins moving back to the other side of the range.

Below is a chart showing a trend that is moving to the upside with pull-backs.

MARKET VOLATILITY

Just a quick note for you here about volatility. The time during the day that the New York Stock Exchange is open, 9:30 am to 1:00 pm eastern time, is generally the most volatile time for trading futures. It is usually somewhat slower after the market closes, with some occasional big moves. There are often some nice moves around 3 AM eastern time (mid-night Pacific time). I have heard that much of the volatility in the late night or early morning comes from the London Market.

The cause of most market volatility is what is called “big money” or “institutional trading.” There are banks and large trading firms that buy or sell a lot of contracts all at once to move the price as they wish and then once it is there they often buy or sell in the opposite direction, though they may buy or sell again in the same direction. This is one of the reasons that it can be calm one moment and the next there is a quick spike of drop of several or many points. These large buys or sells are able to allow these “big money” groups to profit by knowing which way the market will go and when, but also it can allow them to lower or raise the price and then get a large order in at a preferred price level. Investapedia describes institutional trading verses retail trading in this way: “Institutional traders buy and sell securities for accounts they manage for a group or institution. Retail traders buy or sell securities for personal accounts. Institutional traders usually trade larger sizes.” The chart below shows an example of institutional money being dumped into the system. I am not surprized that it is a Friday that this occurred. BIt is because of this kind of activity often occurring on Fridays that some wise futures day traders stop trading early on Fridays. I have often seen some crazy up and down volativity and volume during the last hour on a Friday.

Another big cause of volatility is news. News can cause quick moves, as people respond to the news. An example of a news event could be an announcement of a change in the federal interest rate.

SCALPING ALLOWS FOR LESS MARKET EXPOSURE

A scalper will try to take several or many small profits each day. It may just be 3 to 5 trades a day, or possibly more than 30 or 50 trades a day. But the scalper is looking for high probability trades that will give at least 2 or 3 ticks and then exit the trade quickly to keep the odds of winning high. Those who are looking for longer trends may use scalping techniques when price is stuck in a tight range for a while. Any trade can be changed into a scalp trade. Scalping may not be as easy or as profitable as longer term trading, but it may be a safer strategy if it is done correctly. One of the main reasons it is safer is because of the short period of time that a person is exposed to the market forces. This is called market exposure. The longer your money is in the market, the more possibility there is for a big movement to go the wrong way and put you in a large loss. Of course that risk is low if a proper stop loss is set and adjusted with movement.

BE PATIENT AND WAIT FOR A GOOD TRADE

Being patient and waiting for a good trade really is a very important part of a winning strategy. The more experience you have in futures, the more you realize the importance and value of staying out of the market until the right opportunity presents itself. You want to keep your money right? Then be patient and wait for a good trade. After this principle, the next hardest thing was to learn to set a good and appropriate stop loss. But back to the point at hand, waiting for a good trade. It is very tempting to just jump into a trade because it looks like it might be good. With time, traders are better able to make quick decisions that are good. And that is because they have made so many bad decisions. In the beginning, it may help you if you write down exactly what set-up you are looking for and then make sure that what you see is really what you are looking for, before jumping into it. Risk management is usually the most important skill that traders need to learn if they will be profitable. It is not as difficult to make a few wins as it is to keep your profits. As I am going to discuss in more detail later, probably the most important part of risk management is to learn to stay out of the market and wait for the right opportunity. And, as I said above, the next hardest thing to learn is to set a stop loss. If you can prevent large losses, it will really help a lot for profitability. But staying out of bad trades by waiting for a good trade will help your profit and loss tremendously.

MOMENTUM TRADING

Momentum trading is a very important part of trading futures. Investopedia says, “Momentum investing is a trading strategy in which investors buy securities that are rising and sell them when they look to have peaked. The goal is to work with volatility by finding buying opportunities in short-term uptrends [or downtrends] and then sell when the securities start to lose momentum.” This kind of trading strategy is a big part what most successful futures or forex traders practice. When you see momentum and volume pick up, it is often a good time to watch for an entrance.

USING A SIMULATOR -VS- REAL MONEY

It takes time to gain experience, but you can get experience for free using a trading simulator, or demo account, and I highly recommend starting with a demo account to learn the software and to get an idea if you are ready to begin using real money. But using a simulator is not the same as using your money. When you start using real money you will feel much more when you make or lose money in a trade. So, it will be much easier for you if you start with just one micro, which is the smallest trading quantity in futures.

Also, using real money in trading makes the trade much more interesting, so it easier to learn and remember things that happen. The pain when you lose real money is much more memorable than when you lose on the simulator. And of course, the pleasure of a big win is very motivating to remember what you did right, so that you can do it again. So, when you are ready, using even just one micro will make your learning experience more memorable.

THE REVERSAL STRATEGY

Possibly the most basic strategy is the reversal. In order to use this strategy effectively you must have a good idea where the reversal is likely to take place. No one can ever know the exact spot where a reversal will take place, but having a good understanding of support and resistance will help a trader gain some confidence in where there may be a higher probability for a reversal. I do believe that support and resistance areas are important to understand, although I would say that, for me, it accounts for less than about 10% of my trading decisions. I believe that the information that can be learned from price action and patterns are much more informative for a trader. Of course, support and resistance areas are related to patterns.

SUPPORT AND RESISTANCE

This is one of the basic strategies for trading Futures. There are a number of strategies that rely heavily on using knowledge of support and resistance. The reversal strategy, described below is one of them. Many traders use moving averages as one kind of way to understand support and resistance levels also. I want to be clear about the value of putting in time to practice, because even after some of the best strategies are learned, experience trading is still one of the most important parts to being a profitable trader. You should know where the support and resistance lines are now, and estimate where they may be going. In order to determine the support and resistance lines, you just need to look and see the most recent pattern lows and highs. I will put a few charts as examples for you below. However, even though support and resistance does give good information, it is not enough to determine an entry. You certainly want to consider what is happening with the price action. And although these charts below make support and resistance look simplistic, it usually is not so simple as it might seem. I have included some videos on support and resistance. They are below the charts. I think that they will be very helpful.

SO, HOW DO TRENDS, PULLBACKS AND REVERSALS WORK TOGETHER?

Generally, a trending move will be short in time, a regressive move longer in time. The reason for this is that when a majority of traders believe the movement will continue in a particular direction long enough to make a good trade, there will be a large percentage of people jumping on the trade, which makes it move faster. A strong move might get a small pullback or correction of about 30%, a medium move may get a correction of about 50% and a weak move will get a larger correction of about 70%. So, when the trend has just begun and the first pullback moves back about 30% and then the move starts to continue, that is a great time, so far as probability, to be a part of that move. Elliott Wave Theory, just below, will help to explain the process of a trend movement.

ELLIOTT WAVE THEORY

Based on the Dow theory and recurring cycles in nature, known as Fibonacci patterns, Elliott came up with his theory of motive and corrective waves.

Elliott said that the beginning of a trend is marked by significant volume, rapid moves and also with heavy and steep corrections. The reason is this: As many traders are still not believing that there is a reversal, they still sell or buy in direction of the previous move. So then, the first wave is often mostly corrected by large overlapping price ranges, since the changing market conditions have not yet become apparent. But when it is clear that the trend has ended, new money begins pouring in and traders are quickly moving on the new opportunity to make a profit. The volume begins building and price movement is beginning to be an explosion. So, people are now hurrying to get in on the new trend.

Now, as most of the seasoned traders have got onto the move and some begin selling, there are some who are still getting into the move and hoping for quick and easy profits, but the sell off is stronger than the push and a second pullback or correction takes place. So, the next move in the direction of the trend, if there is one, will be weaker and shorter and may not even make new highs. The following chart illustrates this theory.

INDICATORS CAN HELP A LOT

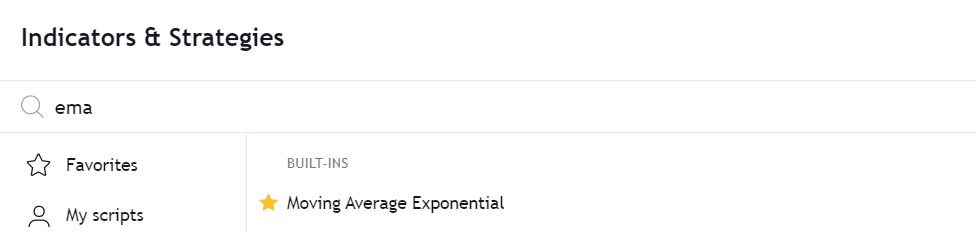

Some people trade with no indicators. But most traders like to have some kind of a reference indicator on their chart. On TradingView the indicators can be found by clicking the indicator icon (fx) as in the picture below.

The Four Indicators That I Use

or, I did use. Now I just use the first one.

THE 1ST INDICATOR

THE 9/26 DOUBLE EMA INDICATORS – This is all you need.

I call this strategy the “Gold Line” Strategy. It uses two EMA’s. Let me explain the EMA.

All you need to do is set up two EMA’s from the indicator options. So, this strategy should work with any platform, though I think it is best to see it visually on TradingView or some platform that has a chart option that will appear similar to what you get on TradingView. So, after you get two EMA’s on your chart, you need to click on the settings and set one to a 9 EMA and the other to 26 (Sometimes I use the 5 instead of the 9). I set the 9 to a nice gold color. That way I can follow the gold line to the gold (I’m referring to gold as money here). Using this strategy, you will consider buying or selling AFTER the GOLD LINE (9 EMA) crosses the line that is set to a 26 EMA (Turquoise color in these charts, but now I use blue for the 26 so I don’t get confused as to which line is which). On this stategy, you will want to get in pretty quickly after the lines cross (but wait for a pull-back in most cases) and then get out pretty quickly after the gold line stops moving up, or down if you’re going down.

Of course, it will not always work perfectly. There’s not much in trading that always works on the “make profit” side of things. You will usually want to take into consideration other things to add some areas of confluence before taking the plunge. But it is a very good reference. You may want to practice the “Gold Line” stategy using market replay or playback, which is practicing with old market data. I highly recommend that you use market replay. It will help very much, even with just one hour of trading at about 50x (speed) or 100x.

Make sure that you set the two EMA’s to the correct settings and colors you want before you start using them. Just click the “settings” wheel icon next to the description of the indicator at the left of your screen. It is about the fourth down from the top left of your chart. If you don’t see the indicators it is because it is toggled off and you just need to click the little black toggle symbol. You can see examples in the section of this website titled, “Chart Examples.” Also, at the same “Chart Examples” see the examples of the “Gold Line” crossover.

REMINDER: LEARNING TO TRADE PROFITABLY IS NOT QUICK OR EASY

I want to add a quick note here. Just because I show these indicators and it may look super easy to get in and make a lot of money, doesn’t mean that it is actually easy to make a lot of money. If it was easy, everyone would be making a lot of money doing this. It takes a lot of practice to get good. Like I said in the “Advice” module, expect several months to start getting a good feel for everything and then it may be many more months before you get good enough to be consistent at making a profit. There is a lot to learn and it takes a lot of practice. But if you want to do this, just keep working on it and you will continue increasing the probability that you will be one of those who become profitable on a regular basis.

THE 2ND INDICATOR (I don’t use this now, just the 1st one above)

The RSI Indicator. This is a very helpful indicator for making money. the RSI (Relative Strength Index) is used to see when prices are likely to pull-back or reverse. When this goes up above the 70 dotted line it is likely to start a sell off soon. But don’t get in until the sell off is showing good reversal movement because sometimes price will continue up much higher even after passing the 70.

When the RSI line goes below the 30 dotted line at the bottom it is likely that buying will begin soon. But as I just said, wait for a good buying indication before getting in because it can continue to go down for 10 or 20 points more sometimes. But this is a very helpful indicator if you use it correctly, not as a single source for an entry decision. Wait for good reversal or pull-back movement before deciding to get in. It is okay to miss a little of the action which is much better than being in when it keeps going the wrong way.

THE 3RD INDICATOR (I don’t use this now, just the 1st one above)

The Stochastics Indicator. This helps to show some probability of direction. It is especially helpful if you take into account the differences in the different time frames. So, that means that you click on the one minute, the three minute, and probably the five and fifteen minute time frames to get a good idea what is going to be happening in all the time frames. The best entrances are when all the time frames are moving in the same direction, but at least preferably the one and the three. This is a very helpful indicator. It also includes a volume indicator at the bottom of the stochastics indicator, so I don’t add the volume indicator seperately.

Before moving to the 4th Indicator, here is an additional strategy.

I put this next strategy in this area because it will be easier for you to understand Divergence after you have learned about the RSI and the MacD.

DIVERGENCE STRATEGY (I don’t use this myself)

Divergence is when the indicator is showing the price movement in a different way than the price is actually going. You can watch his video if you want by clicking on this link, Best RSI Indicator Trading Strategy. His teaching on using divergence to predict reversals is very good and not hard to understand. It is some work to watch and use while the market is moving fast. And remember, if you saw the video, a small divergence would indicate the probability of a small reversal, while a larger divergence would indicate the probability of a larger divergence. The example below is a very small divergence, but the price still moved down six ticks. I want you to know, that although I see potential for this divergence strategy, especially if someone buys a special indicator to provide an alert when there is a divergent pattern, but I have not yet used it more than just once or twice. I may buy a special indicator in the future to alert me about this special pattern, though I am not planning to. What I am planning to do is to trade only the “Gold Line” cross set-ups. I am looking at one that is called a divergence indicator. It is priced at $449. Their website, TradingIndicators.com sells a lot of indicators and probably makes very good money doing so. I am not an affiliate for them, just letting you know about them. The link above goes directly to the divergence indicator that is for using with TradingView. They make indicators for many platforms.

Below, on the chart, I found one small area of divergence on a live chart that I can show you. I was using the MacD, not the RSI, though the RSI is supposed to be a little better at showing divergence.

THE 4TH INDICATOR (I don’t use this much, just the first one above)

The Volume Indicator. You will see this on some of my charts. It can be helpful to show volume spikes, but takes a lot of space. Some one minute time frames later in the day may have as few as one or two contracts of volume, while others may have ten thousand contracts of volume in a single minute. This super big volume is almost only only going to happen in the last ten minutes before the New York Market close, which is 4 pm Eastern or 1 pm Pacific time. To find it, just search in the indicator symbol for “volume.”

Market Replay

MARKET REPLAY MAY BE HELPFUL

I was told a couple of times how helpful it is to use market replay to speed up your learning process. I ignored the advice until recently. I should have done it sooner. After doing a few hours, I see why it is recommended. It is really helpful and important for seeing how much more money you can make if you buy at a low or high and then hold it for the move to come back to the middle, which it often does. I suggest setting it on 50x to 100x speed for market hours and probably at 500x to get through most of the evening or night hours, if you even want to do the evening. This may be a really big for help for a person to see the patterns and how easy it is to make money when there is not so much waiting time. Each time that I did it I made a lot of profit on the simulator. Each time I started at zero and had about $5000 after about one hour (one or two trading days on 100x) – and with about a 90% win rate too.

So, how to do market replay? Here is a link for NinjaTrader Market Replay Instructions. And here is a link for how to use TradingView Market Replay. The screen below is how my chart looked on market replay on NinjaTrader.

VIDEO EXAMPLES

You may be interested in a few videos about support and resistance. This first video, below, is very good, but even though what he shows is good, reversals do not usually follow the nice pattern that he shows. If they did it would sure make trading a lot easier.

One YouTuber that has talked about chart patterns with futures is Michael Chen. You may want to check his videos. Here is one (below) that he posted February of 2020. In his videos, he makes it look really easy to make about $500 a day, trading futures. Do take into account that he has been doing it for a while. He is using a mini contract, where each tick is worth $12.50. He usually trades three contracts at a time. So, if he gets his calculation right, which he almost always does, at least on his videos, he makes $150 each time. I will remind you that in order to trade three contracts of the S&P 500, like he is, the minimum deposit in your account would need to be $1200 with Amp ($1,500 with NinjaTrader), but preferably more to have a comfortable margin. And again, it is wise to start out with just one micro per trade, after you have spent considerable time getting familiar with trading by using the demo. If you want to see more of his videos, you can use the following link to get to his YouTube channel. He also offers a course. It was $400 last time I checked.

This next video shows more on support and resistance. He makes a lot more of support and resistance levels than I do. I will say that there are times when support and resistance works better than other times. Having said that, learning how and why price moves is important, but can take a long time. It is true that Indicators are lagging behind, so they tell you the past not the future, however, the past can often give quite reliable predictions about the future. I find that using the 5-26 EMA crossover strategy or the TUX buy / sell indicator, along with a lot of practice, really does help, and is simple. I do watch support and resistance areas and apply these principles. Many traders put a line on their chart to show the low and high of the previous day. I will often do some things like that too.

There are other variables that are influencing price action, besides support and resistance. For example, there is the momentum or follow effect. As people buy, it attracts others to buy. So, as momentum gathers, it attracts more people to join in with the emerging pop or trend. The guy in the video, Marcello, also offers courses. I imagine that they are very good. A reviewer of TradePro Academy, where Marcello teaches, says, “TradePro Academy is an online based educational resource for traders. They offer monthly subscription based packages ranging from $79 to $139 monthly.”

CHART PATTERNS AND CANDLESTICKS

CHART PATTERNS

There are many stock chart patterns, but maybe about 10 – 20 that are most often used. The two that I hear used the most in futures and forex are the “head and shoulders” and the “two legged pull back.” If you want to learn chart patterns now, click on the link just below for a website that discusses ten of the most often used chart patterns for futures trading. I am not going to teach chart patterns. In addition to the website that I link to above, there are many YouTube videos that you can watch if you want to learn more about chart patterns. I would search, “chart patterns for futures.” Even though it can be helpful to know some chart patterns, you can be a profitable futures trader without knowing or using chart patterns, so don’t think that you need to study chart patterns. If it is not something that is interesting to you, then you can skip it, at least for now. You may decide that you are interested later. But chart patterns take a little time to learn and that is outside of the scope of this introductory course. This next section is especially important for a beginner to understand.

CANDLESTICKS AND OTHER OPTIONS FOR CHARTS

I will tell you how time frames work together with candlesticks. Candlesticks have long been the most popular way for traders to view price action movement on a graph. When candlesticks are being shown to represent the buying and selling action on your chart, each candlestick represents the amount of time that the chart has been set to show. So, if you are on a five minute time frame, each candle represents five minutes of data. If you set the candlestick time frame to one minute, then each candlestick will show what has happened for that one minute time frame. For a quick scalp, you will mostly use the one minute time frame. To see trends effectively, traders will need to see different time frames.

Some traders, especially in the last few years, believe that another way to see price action on a graph is better. This newer option is a “range” or “tick” option which is not time-based. The range based option is based on the amount of volume that is being traded. The volume per tick (also called a pip in Forex) may be chosen by the trader. The count of ticks (or pips) for each range varies by software or a traders choice and is often four to twenty. So, instead of time being measured, movement of the market is measured by the volume of ticks or pips. A very accomplished trader, who goes by the name, Vinny E-Mini, is one of those who believe that this kind of price tracking is much better. You can easily find him in YouTube. I will also give you three links that you can check to learn about range charts if you want to. They are here, here and here. I currently trade with time based candlesticks when using TradingView and I like it, but on NinjaTrader I also use some range bars or tick charts occasionally.

Note: You will find, “Chart Examples” at the second to last module in this course. They are very helpful for learning to trade profitably.

I recommend using only the first indicator. That is, the two EMA’s, setting it up like I showed above so that you sometimes have a gold line crossing a blue line. This strategy works best for me.

That is the main thing.

I would usually take just 3-5 ticks at a time, especially when using larger size, but there are always exceptions. After getting your 3-5 ticks, it may drop or it may continue up, but playing it safe with careful scalps is especially better for those with less experience (maybe less than about 1000 hours of futures trading experience).

Sometimes you may want to ride the winners till they stop, that is up to you. When you do, you will want to move your stop loss to keep it within 6-15 ticks depending on many factors.

And, of course, there are times that it does make sense to go against the trend, but mostly only in special situations like the last two minutes before and after the close at 4 PM Eastern Time.